td ameritrade tax calculator

TD Bank and TDWMSI are affiliates. Our Resources Can Help You Decide Between Taxable Vs.

Calculating Regulatory Aum Vs Assets Under Advisement Aua Regulatory Asset Management

If you pay online with eCheck electronic withdrawal from your checking account there is a 075 FLAT FEE.

. All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099. Plus Tax Amount 000. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

The Realized GainLoss tab lets you filter for a specific time period and displays sells and corporate action events such as mergers and spin-offs see figure 2. Figuring out what you owe in income taxes might seem daunting but there are ways to make it easier. Ad Open an Account with TD Ameritrade and Download the thinkorswim Mobile App.

Use our required minimum distribution calculator to estimate the distributions you are required by law to withdraw annually based on your birthdate. Our retirement income calculator determines how much you need to retire based on your current age income and health. Brokerage services provided by td ameritrade inc member finrasipc and a subsidiary of the charles schwab corporation.

To import your TD Ameritrade account information into TaxAct. Before Tax Amount 000. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc.

Withdrawals of taxable amounts are subject to income tax and if taken prior to age 59 12 a 10 federal tax penalty may apply. This TEY calculator is intended to be used only as a general. Early withdrawals may be subject to withdrawal charges.

TD Ameritrade offers tips on how to calculate your income taxes where to find the a helpful income tax calculator the types of deductions you may be eligible for and more. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. Your tax forms are mailed by february 1 st.

Discover Helpful Information And Resources On Taxes From AARP. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account.

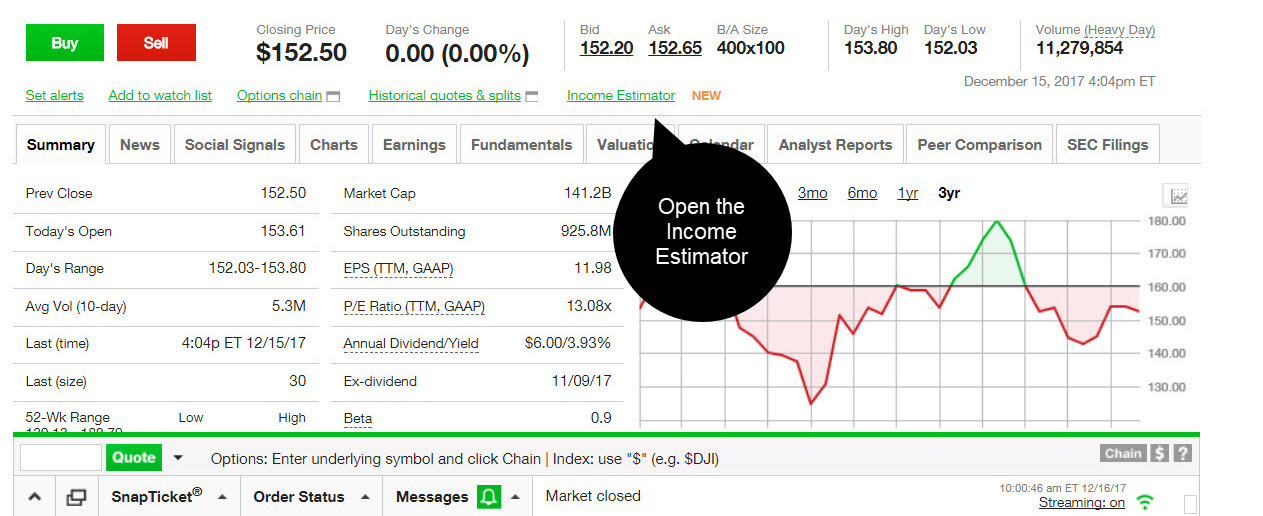

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Whats My Potential Income The New Dividend Income E - Ticker Tape. And The Toronto.

Select your federal tax rate. Our IRA Selection Tool helps determine your IRA eligibility and how much you may be able to contribute to either a Roth or Traditional IRA. The tool also lets you look back at a companys historical dividend payments to see if theres a trendwhether positive or negativein.

Select your state of residence. Td ameritrade tax calculator. Trade for a Living.

Td Ameritrade jobs in Orangeburg NY. The new Income Estimator tool shows you various data points for dividend stocks and ETFs such as. An annuity is a tax-deferred investment.

While the funds cannot remain in a tax-deferred account they can be put into a taxable account. Td Ameritrade jobs in Orangeburg NY. The Client Service Specialist provides excellent service operation and sales support to the Branch staff and our clients.

Enter an amount into the calculator above to find out how what kind of sales tax youll see in Orangeburg New York. Calculate the required minimum distribution from an inherited IRA. Tax Bills are available to View andor Print for the past 10 years.

TokenTax using this comparison chart. Depending on your activity and portfolio you may get your form earlier. You can pay your State Town and County Taxes and School Taxes online.

Mark-to-Market Trader Taxes. TD Ameritrade does not provide tax advice. Calculate the required minimum distribution from an inherited IRA.

You must enter the. Taxes related to td ameritrade offers are your responsibility. Please consult a legal or tax advisor for the most recent changes to the US.

Tax code and for rollover eligibility rules. Clients may be referred to TD Ameritrade Inc member FINRASIPC TD Ameritrade for brokerage services and additional investing choices. TD Wealth Management Services Inc an insurance agency TDWMSI offers insurance products.

From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top left corner of your screen then click Federal. Enter the yield to maturity or yield to call of the Municipal bond. Companies looking for a Crypto Tax solution Audience.

Your taxable equivalent yield is Click the Calculate Button. And foreign corporations capital gains distributions mutual fund dividends federal and foreign tax withheld and. You can also view whether your positions are categorized as long term or short term.

Minus Tax Amount 000. Use our IRA Selection Tool to find out. Compare price features and reviews of the software side-by-side to make the best choice for your business.

It shows wash sale information and any adjustments to cost basis when applicable. All payments are processed the same day. Page 1 of 4 jobs.

VIEW OR PAY TAXES ONLINE. TEY is only one of many factors that should be considered when purchasing a security. Individual investors that want help to pursue their financial goals through brokerage.

Greene-Lewis says taxpayers who arent sure how they might file can use a standard-versus-itemized deductions tax calculator to figure out their status. The gross receipts tax is much like a Value Added Tax only for businesses rather than individuals. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc.

TD Bank Group has an. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. This easy and interactive tool analyzes your age tax filing status income and employer offered retirement plan in just a few simple questions to help you determine.

Four states impose gross receipt taxes Nevada Ohio Texas and Washington. All guarantees are based on the claims paying ability of the insurer. Compare price features and reviews of the software side-by-side to make the best choice for your business.

- Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home. TD Personal Financial Services is a unit of TD Wealth. Click TD Ameritrade from the list of financial.

If youre selling an item and want to receive 000 after taxes youll need to sell for 000. Client Service Specialist - Paramus NJ. TD Ameritrade using this comparison chart.

Census data on employees if applicable. This includes month and year of hire birthdate and W-2 Income. Optional riders are available at an additional cost.

To import your TD Ameritrade account information into TaxACT follow the steps below. The rate calculator reflects the rate deviation filed by Stewart Title Insurance Company. Click the Investment Income dropdown click the 1099 import from institution.

Td Ameritrade Tax Calculator. Ordinary dividends of 10 or more from US. One of the biggest changes in the tax code was a change to the standard deduction which was nearly doubled to 12000 for individuals and 24000 for married couples filing jointly.

Estimate your small business retirement plan contribution. Simplify the process of calculating contributions and determining employee eligibility in your business retirement plan with the Small Business Retirement Contribution Calculator.

Buying A Duplex Triplex Or Fourplex The Ultimate Guide

What Is Cash Reserve Ratio Statutory Liquidity Ratio Crr Vs Slr Fintrakk Banking Institution Best Credit Cards Cash

Free Stock Trading Td Ameritrade

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

Td Ameritrade Review 2022 Nextadvisor With Time

How To Fix Thinkorswim S Delayed Data And Get Real Time Data For Free Credit Card Help Real Time Financial Goals

2022 Td Ameritrade Review Pros Cons Benzinga

A Forex Profit Calculator Can Help Calculator Forex Profit

Tax Efficient Fund Placement Bond Funds Fund Accounting Corporate Bonds

The Best Retirement Calculator Review I Review 26 In One Day Calculatormountain Chief Mom Officer Retirement Calculator Cnn Money Retirement

What S My Potential Income The New Dividend Income E Ticker Tape

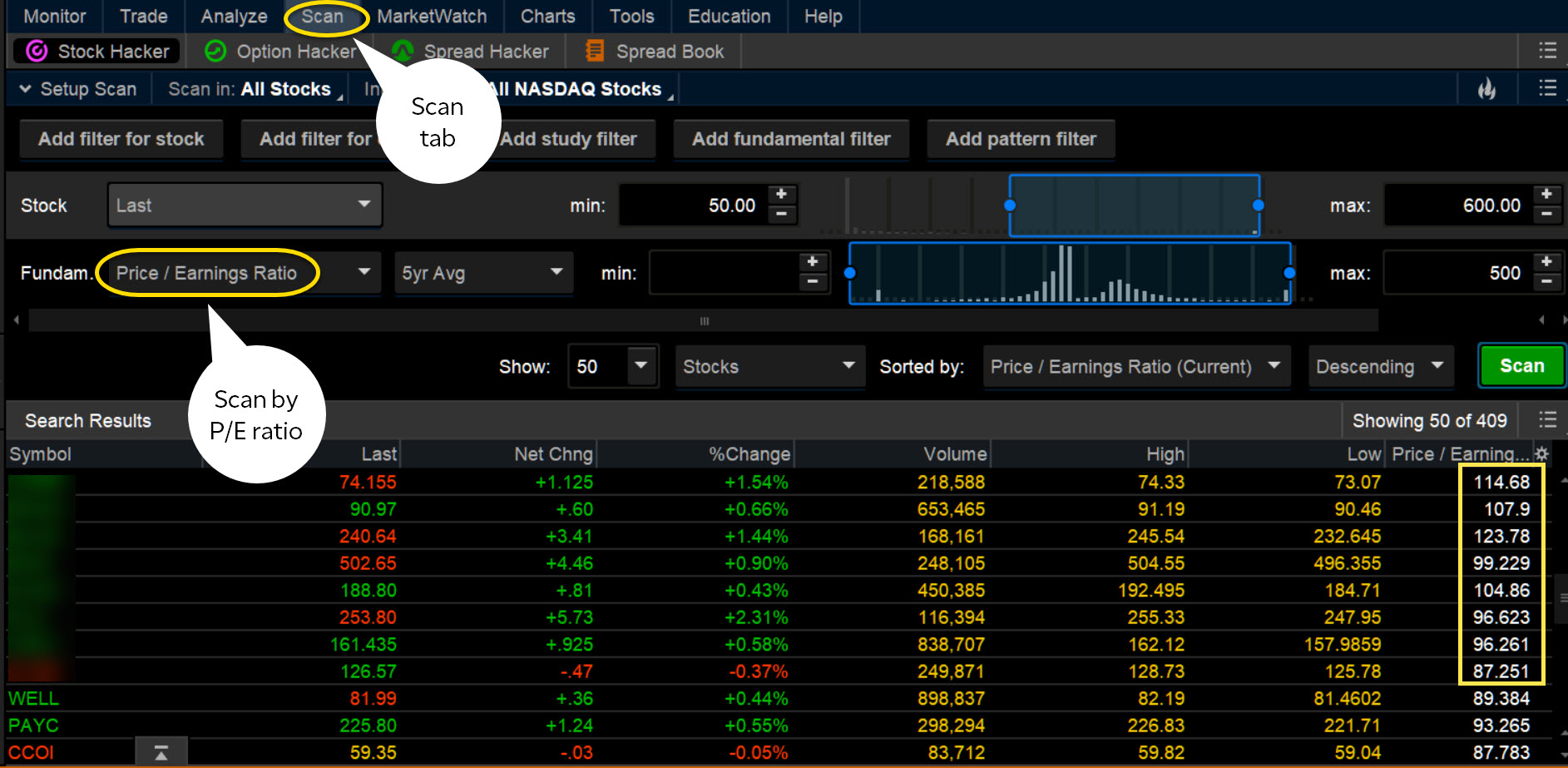

Price To Earnings Ratio The Price Is Right Right Ticker Tape

2022 Td Ameritrade Review Pros Cons Benzinga

Pin By The Accounting And Tax On Accounting And Tax Solutions In 2021 Day Trading Stock Trading Marketing

What S My Potential Income The New Dividend Income E Ticker Tape

Td Ameritrade Essential Portfolios Review Smartasset Com

How To Fix Thinkorswim S Delayed Data And Get Real Time Data For Free Credit Card Help Real Time Financial Goals

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)

/TD_Ameritrade_Recirc-97600f27bf3b427eba91b3218de8038e.jpg)